Editorial

As cash loses its dominance and cryptocurrencies make waves, the shift to digital payments is about more than convenience—it’s about automation, security, and flexibility. Central banks are responding by introducing Central Bank Digital Currencies (CBDCs), with China leading the way and others following suit.

Why does this matter to you? Digital payments are about inclusion and growth, especially for small businesses and marginalized communities. They open doors that cash and traditional banking have kept closed, aligning with the UN’s Sustainable Development Goals.

In this edition of “This Week in Consulting,” we explore the rise of digital payment all around the globe. How innovations like India’s Unified Payments Interface (UPI) and strong government support have made digital transactions the norm, transforming the financial landscape and enhancing security and convenience.

In Europe, new regulations are poised to disrupt the financial services industry, forcing banks and payment providers to adapt—or risk being left behind. The future isn’t just digital; it’s securely digital.

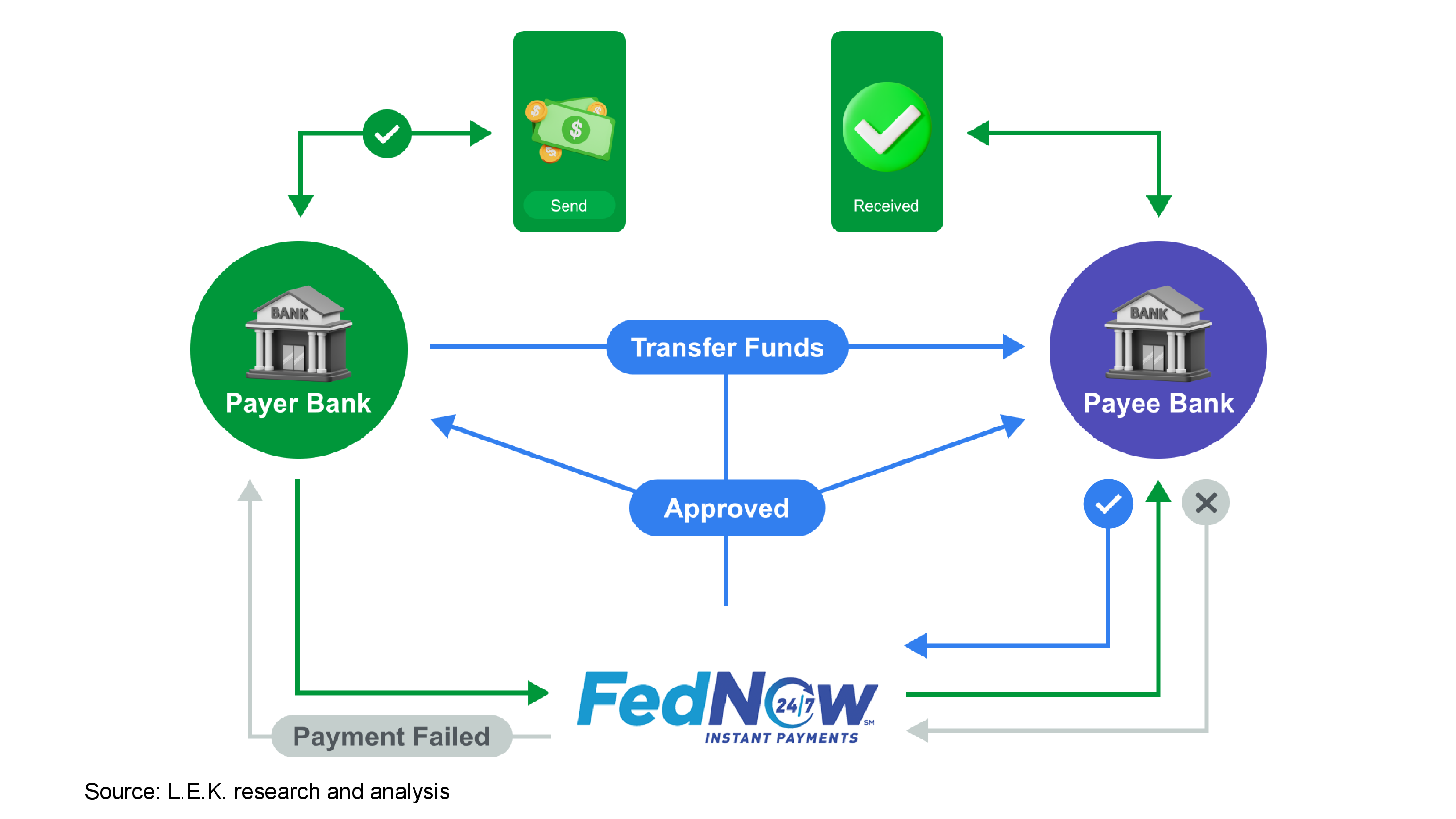

Meanwhile, in the U.S., the Federal Reserve’s FedNow system, launched in 2023, is revolutionizing cash flow management for consumers, small banks, and businesses.

What’s at stake? Everything—from how businesses manage money to how consumers experience financial services. Curious about how this will impact you? Let’s dive in.

Laurent THOMAS

Chairman Consulting Quest

This week’s must read

In this edition of This Week in Consulting, we explore the how digital payments are redefining global finance all around the globe.

In this article by PA Consulting, central banks are exploring Central Bank Digital Currencies (CBDCs) as cash usage declines. CBDCs offer programmable money, controlled by central banks, unlike volatile cryptocurrencies, and could enhance financial inclusion, monetary sovereignty, and challenge traditional financial systems.

This week’s media

In a video by HKU FinTech, experts explore how advancements in digital payments can enhance financial inclusion, especially for small businesses. The discussion highlights the role of digital payment ecosystems in empowering marginalized groups and driving economic growth under the UN’s Sustainable Development Goals.

Thought Leadership

This article by Giesecke+Devrient explores India’s rapid shift towards digital payments, driven by initiatives like UPI and supported by government regulations. Despite cash’s continued relevance, digital transactions, especially via QR codes, are revolutionizing India’s financial landscape, enhancing convenience and security.

LEK Consulting explains FedNow, the Federal Reserve’s new instant payment system in the U.S. Launched in 2023, it offers real-time transfers for consumers, small banks, businesses, and payment services providers, enhancing cash flow management and levelling the competitive field.

This article by Entrust highlights the rapid growth of digital payments. Financial institutions must invest in secure, future-ready digital payment solutions to meet customer expectations, enhance security, and remain competitive in the evolving financial landscape.

This EY article discusses how upcoming EU regulations will transform the financial services industry, emphasizing the need for banks and payment service providers to adapt their infrastructure, business models, and compliance strategies to stay competitive in a rapidly digitalizing market.

This week’s consulting news selection

Accenture has announced a few new appointments including Arundhati Chakraborty as group chief executive of Accenture Operations along with Yusuf Tayob, who will become the global Communications, Media & Technology industry practices chair.|

CIMA+, one of the largest private consulting engineering firms in Canada, announces the acquisition of GTA Hydro, a consulting firm operating in the hydroelectric energy production sector since 2015.|

MNP, one of Canada’s largest national professional services firms, is pleased to announce that it will join forces with the Kamloops, British Columbia-based firm, Finnie Hunka LLP.|

Elixirr has announced its latest addition to its partner team, Joe Hubback. With over 20 years of experience in the cybersecurity, technology and industrial sectors, Joe brings a wealth of knowledge and expertise beyond strategic initiatives and profit growth.|

Laurent is the Chairman and Co-founder of Consulting Quest. Focused on greater value creation, and being thoroughly familiar with Consulting, Laurent has sourced and sold millions of dollars worth of Consulting over the course of his career. Prior to joining Consulting Quest, Laurent was Executive Vice President Oil and Gas at Solvay and Senior Partner Transformation at Oliver Wyman.